marin county property tax due dates 2021

September 28 2021 at 411 pm. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

115 Real Estate Infographics Use To Ignite Your Content Marketing Updated In 2021 Real Estate Infographic Real Estate Tips Getting Into Real Estate

San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm.

. 10 to avoid penalty. First Installment of Property Taxes Due Monday 121216. A payment drop box will be available under the Marin County Civic Centers southern archway at 3501 Civic Center Drive San Rafael during business hours.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Taxpayers are being asked to pay online by phone or by mail rather than in person at the Marin County Civic Center to avoid. Reply 1 The first installment of property taxes is due Nov.

Duplicate bills are available on request. Senior Low-Income Exemption Measure K L - To qualify for a 3600 Senior Low-Income Exemption for a single family residence you must be 65 years of age or older by December 31 of the tax year 2021 own and occupy your residence located in the Special Tax Zone 2 of the Marin County Free Library District or the Town of Corte Madera and earn a total annual household. Online or phone payments recommended by Tax Collector.

This coming Monday December 12 is the last day to pay the first installment of Marin County property taxes. All secured personal property taxes. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

Monday April 12 a date not expected to change due to the COVID-19 pandemic. Local property tax revenues are needed now more than ever. Marin county property tax due dates 2021.

The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. Dance degas lesson wallpaper. Main Office McPherson Complex 503 SE 25th Avenue Ocala Florida 34471 352 368-8200.

Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in. Marin County taxpayers are being asked to pay online by phone or by mail rather than in-person. Property Tax Rate Books.

File by may 31 2021. Tax Lien date affects the upcoming fiscal year Tuesday April 12 2022 Edit. KENTFIELD SCH MEASURE A SPECIAL TAX MAR 2018 10YRS.

The normal office hours are 9am to 430 pm weekdays. 1 and must be paid on or before Dec. A form will automatically be sent to those who filed the previous year.

September 27 2021 at 642 pm. Both installments may be paid with the first installment. In order to meet the deadline to qualify for the exemption on your September 2021-22 tax bill you must file your request by May 31 2022.

You must reapply each year to keep the exemption in effect. Marin County Officials. The first installment of property taxes is due nov.

County of Marin MARIN COUNTY CA Marin Countys 2020-21 property tax. 21 rows First installment secured real property taxes due. If you have questions about the following information please contact the Property Tax Division at 415 473-6168.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. The Tax Collector is located at 3501 Civic Center Drive Room 202 in San Rafael.

Search for real and personal property tax records find out when property tax payments are due accepted payment methods tax lien sales and property tax rebate programs offered by the city and county of denver. LAGUNITAS SCH MEASURE A SPECIAL TAX NOV 2017 8YRS. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

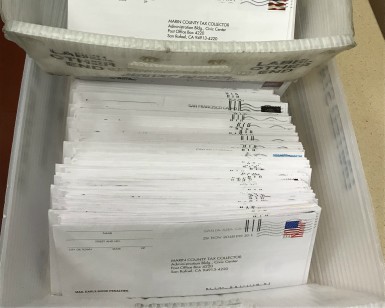

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 1. Penalties apply if the installments are not paid by December 10 or April 10 respectively. Send the correct installment payment stub 1st or 2nd when paying your bill.

Edgar degas the dance lesson. Property tax due dates are not expected to change as a result of the COVID-19 pandemic. Second Installment Of Property Taxes Due San Rafael CA Monday April 11 is the last day for property owners to.

Marin County collects on average 063 of a propertys assessed fair market value as property tax. Revised tax bills may have different due dates so. The second installment must be paid by April 10 2021.

2022 California Property Tax Rules To Know

Marin Residents Have Until Monday To Pay Property Taxes

Property Tax Bills On Their Way

Property Taxes Marin Independent Journal

Sf Wants To Use New Map Of Flood Prone Areas To Inform Property Buyers Property Buyers Flood Map

Thinking Of Moving Your Property Over To An Ltd Https Chacc Co Uk Tax Blog Thinking About Moving Your Propert Buying A Condo Real Estate Real Estate Buying

Publication 225 2016 Farmer 39 S Tax Guide Tax Guide Farm Finance Farm Business

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

4 Ways To Win A Bidding War In 2021 War Dreaming Of You Win

4 Ways To Win A Bidding War In 2021 War Dreaming Of You Win

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Feather 3 Set Metal Wall Art Apt350 In 2022 Feather Wall Art Vertical Wall Art Wall Decor Bedroom

1 895 000 6911 Viso Drivehollywood Hills Los Angeles Ca90068 Hollywood Hills Los Angeles Hollywood

New Zealand Poster By Katinka Reinke Displate Posters Art Prints Travel Posters New Zealand Art

5 Things To Know Before You Choose To Remortgage Your Home Opptrends 2022 Mortgage Payment Mortgage Real Estate Development